‘Cash doesn’t crash’: Coins and notes still ‘essential’ even as mobile wallets overtake ATMs

Carrying cash is becoming less common as people adapt to using digital payment systems. Photo: Getty

Banks are celebrating a “digital banking boom” as mobile wallets overtake ATM withdrawals, sparking warnings from a leading expert that the government must act to preserve cash access.

Figures published by the Australian Banking Association on Thursday revealed that mobile wallet payments have surged 35 per cent in the past year, capping an 18-fold rise since 2019.

Cash accounted for just 7.5 per cent of transactions by value, the report said, while in-person bank branch interactions had fallen by 47 per cent in the four years between 2019 and 2023.

But the transition is happening so fast that experts fear there aren’t sufficient safeguards to ensure those Australians who still rely on cash can access it at branches or ATMs.

Swinburne University Professor Steve Worthington said the decline of cash didn’t make it any less important to Aussies relying on it,

He urged the federal government to take up calls from a recent Senate inquiry that access to in-person banking be considered an essential service, like electricity or water.

“Cash is an essential service for large groups of people, particularly senior citizens and people who live in regional areas,” Worthington said.

“The paradox here is the banks are celebrating all this, but they’re also closing their branches.”

Who uses cash regularly?

Although Australians are using less cash, there are still segments of the population who rely on hard currency for day-to-day transactions, according to multiple pieces of research in recent years.

Figures from the RBA suggest about 25 per cent of Australian consumers would face a “major inconvenience” without cash access.

A big reason for that is a significant portion of the population still use cash for 80 per cent of their transactions, particularly in regional areas and among older demographics like baby boomers.

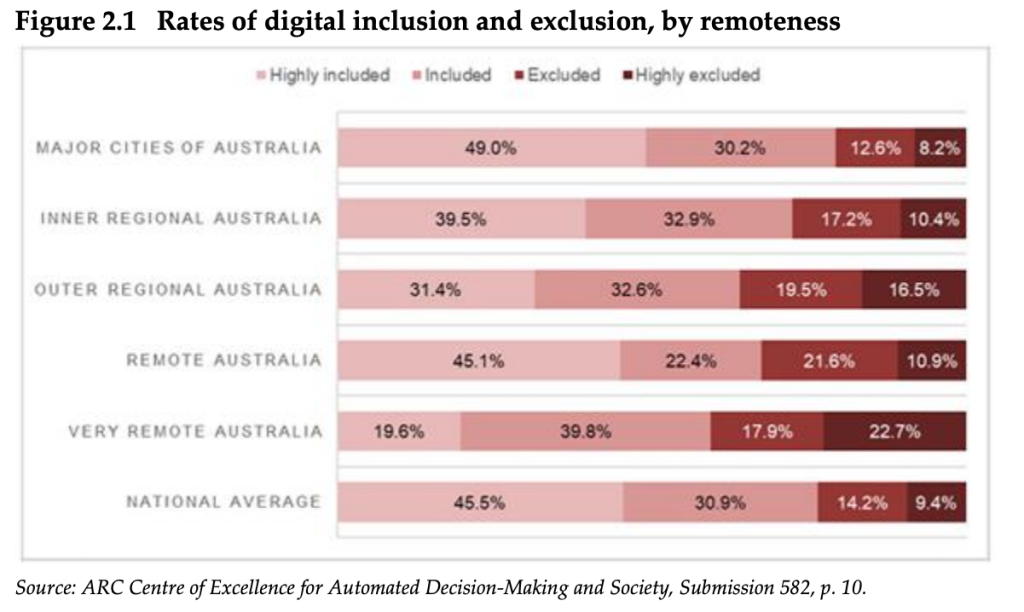

Cash is also the only option for about 15 per cent of people suffering digital inclusion for a variety of reasons – including lack of internet access – according to the Australian Research Council.

That figure rises to about 20 per cent in rural and remote areas, or one in five Australians.

Ongoing use for cash

But the issue with banks pulling back from ATMs and branches in recent years also concerns people who hardly use it any more, Worthington said.

“There are quite frequent outages – telecoms or IT systems have issues, or the power fails,” he said.

“Cash can’t crash.”

The reliability of digital payments systems has been a key concern for the Reserve Bank too, which is responsible for regulating the banks in this area.

It has previously warned the industry must improve the reliability of services as the use of cash declines across the economy.

But Worthington warned vulnerable cohorts of Australians were still being left in the lurch when there were outages, underscoring the need for cash to be declared an essential service federally.

A Senate inquiry recommended as much in May, alongside changes that would require banks to get approval from a regulator before closing any more branches.

The government is considering its response to the recommendations in the report.