Honest Australians pay the price for Coalition’s refusal to come down hard on tax rorts and scams

They may be small islands, but the role of tax havens in the global economy is getting bigger. Photo: Getty

At its peak, the Stawell tyre dump held nine million tyres, making it one of the biggest tyre dumps in the world. After being inactive for more than a decade, the state Environmental Protection Authority finally stepped in and cleaned it up, recycling more than a million tyres weighing around 10,000 tonnes.

Yet when they looked for someone to pay the bill, the government found that ownership of the dump had been transferred to an internet marketing company based in the tax haven of Panama. Asked about the sale, the former owner admitted ‘I have never been to Panama and can’t speak or understand any Spanish’.

When the case went to court, Justice Karin Emerton called the sale of the site ‘outrageous’, suggesting that ‘It’s open to infer that shifting assets between two companies, to a shelf company in Panama, is a device being used to avoid obligations under the fire preventions notice’.

Tax havens are dodgy, and they’re being used to dodge all kinds of obligations. From drug kingpins to terrorists, kidnappers to fraudsters, tax havens are a favourite hidey-hole for wrongdoers.

When the Panama Papers were leaked to the media, they revealed how the super-rich were using tax havens to avoid paying their fair share. It’s been estimated that four-fifths of the money in tax havens is there in breach of other countries’ tax laws.

They may be small islands, but the role of tax havens in the global economy is getting bigger. One investigative journalist calls this world ‘Moneyland’. Another has dubbed it ‘Kleptopia’. Lawyers and accountants design structures that are deliberately impenetrable.

While the accounting tricks might be complex, the result is simple.

When multinationals and the mega-rich avoid taxes, you pay more. After all, someone has to pay for pensions and pharmaceuticals. For every tax-evading multinational laughing away on a Cayman Islands beach, there’s a hardworking taxpayer wondering why they’re being asked to pony up more.

Tax havens make a mockery of the idea of a level playing field. If you’re a startup company, you’re not worried about trying to shift profits to the Bahamas. Most new firms I speak with are more concerned about the lack of rapid antigen tests, skills shortages, and sluggish broadband.

But when overseas-based multinationals use tax havens, Australian companies feel like they’re clean cyclists in a race against Lance Armstrong.

Take the tyre recycling business, for example. How could an honest business compete against one that shifts to Panama to avoid its clean-up obligations? At its simplest, the case against tax havens comes down to three words: It’s not fair.

An eyesore, a health hazard – and a burden on the taxpayer to clean up Photo: Getty

To be clear, we’re not talking about small amounts. On one estimate, around two-fifths of multinational profits are currently booked through tax havens. Australian moguls have stashed over $100 billion in these ‘treasure islands’. Globally, the amount of money sitting in offshore bank accounts might be as large as one-tenth of global GDP.

So what can we do about it? When the OECD and G20 brought together more than 100 nations to strike an agreement on global taxation last year, campaigners gave them half a cheer. The agreement promised a lot, but there was always a risk that it would get delayed. Australia largely sat on the sidelines, raising questions about how seriously the Morrison government takes the issue of multinationals shirking their obligations.

After all, if you want a guide to how the Liberals regard multinational tax avoidance, don’t look at what they say, look at what they do.

When Labor was last in government, the Liberals voted against key measures to crack down on tax evasion, including one that led to Chevron paying an additional $300 million in tax. Upon winning office, they abandoned multiple measures to close multinational tax loopholes. What little they have done since has had Labor’s full support, but it hasn’t been sufficient.

It’s not enough to pretend action on multinational tax avoidance – you need to actually close the loopholes. If the federal government doesn’t act, the shell companies and dirty money will win. And Australia will continue to see abominations like the Stawell tyre dump being sold to a Panamanian shelf company.

No country ever tax-dodged its way to prosperity. If you’re not committed to cracking down on tax havens, you’re not on the side of Australians. Only an Albanese Labor Government will ensure that multinationals pay their share.

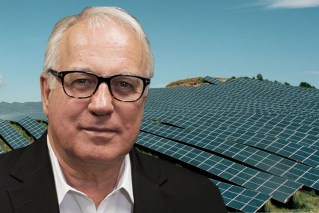

Andrew Leigh is the Shadow Assistant Minister for Treasury. His website is andrewleigh.com