IOOF duo step down to fight APRA action

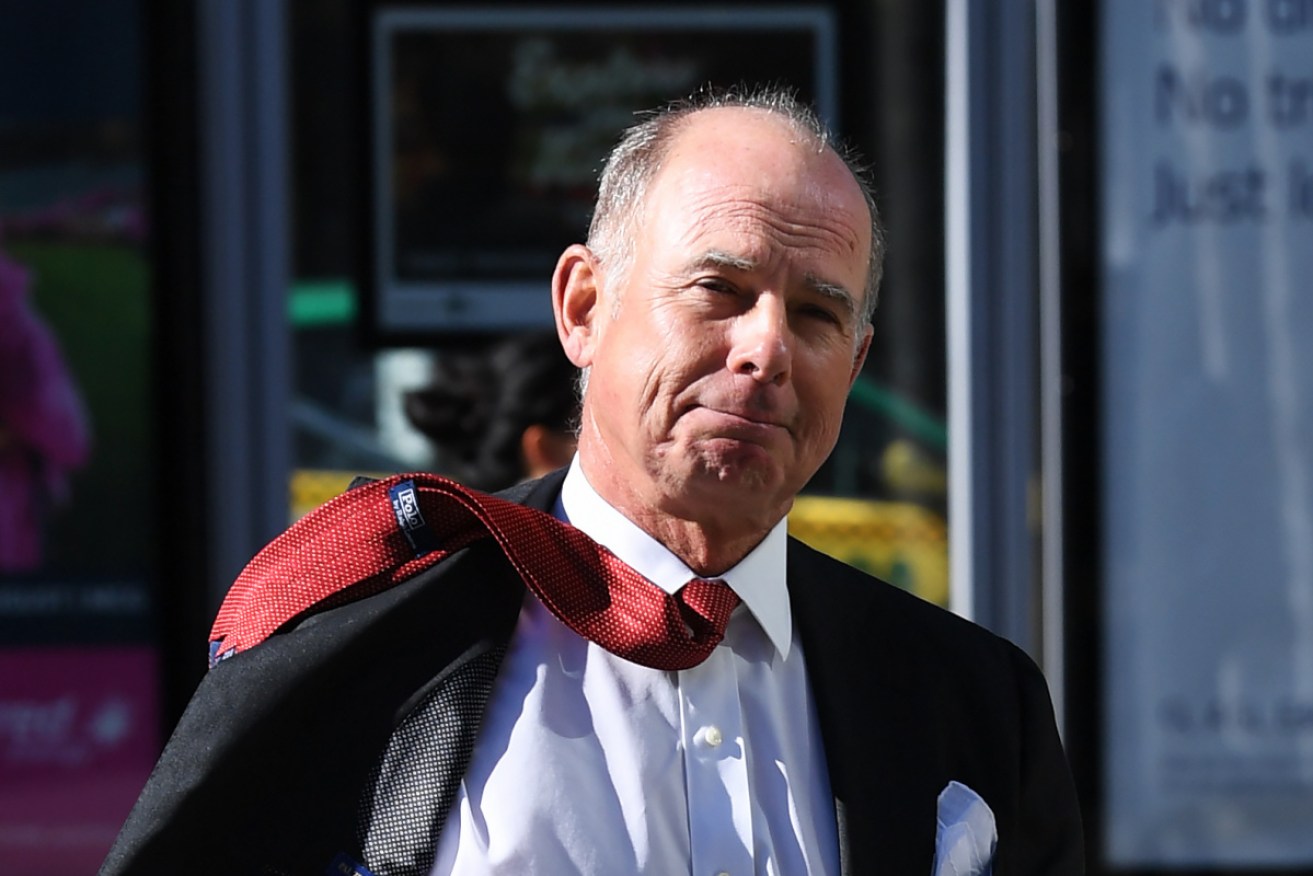

IOOF managing director Christopher Kelaher was one of five senior members of the business facing court for failing to act in super fund members' best interests. Photo: AAP

IOOF Holdings’ managing director and chairman have stepped aside following moves by the prudential regulator to disqualify the beleaguered wealth manager’s top brass.

Managing director Christopher Kelaher and chairman George Venardos have taken leave with immediate effect to focus, IOOF says, on fighting APRA’s accusation they failed to act in their members interests.

The pair have been replaced on an interim basis by wealth management boss Renato Mota and non-executive director Allan Griffiths.

The other three people the Australian Prudential Regulation Authority is seeking to have disqualified from being pension fund trustees – chief financial officer David Coulter, company secretary Paul Vine and general counsel Gary Riordan – stay on but have relinquished any relevant responsibilities.

APRA last week said it has had concerns about conflicts of interest at IOOF since 2015, adding the firm had failed to address the issues for years.

IOOF, whose shares lost more than a third of their value in one session following APRA’s announcement, again on Monday strongly denied the accusations.

“We maintain our position that the allegations made by APRA are misconceived, and will be vigorously defended,” Mr Griffiths said.

Mr Griffiths said IOOF acknowledged the seriousness of the allegations and that he and Mr Mota, would cooperate with APRA on what he called “previously agreed initiatives”, many of which he said were complete.

“We have a responsibility to our superannuation members, shareholders, advisers, employees and the wider community, to take decisive action.

“We are entirely focused on addressing the governance issues in the interests of all stakeholders and will do so in an orderly manner.”

APRA is also seeking to impose additional conditions on the firm.

The move could threaten to derail IOOF’s $975 million purchase of ANZ’s financial planning businesses.

IOOF in October 2017 agreed to buy ANZ’s Australian OnePath Life business and some financial planning operations for $975 million, but ANZ said Friday it was urgently seeking clarification over APRA’s intervention.

IOOF shares, at an all-time high of $11.84 in October 2017, lost 35.8 per cent of their value on Friday and were worth $4.60 before the start of trade on Monday.

-AAP