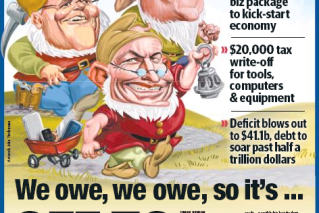

Joe Hockey’s jump start budget

Small businesses were among the winners. Photo: AAP

Joe Hockey has unveiled an ambitious sales pitch for an early election that seeks to lock in the Coalition’s core constituency while overturning the harsh Thatcherite tones of his first disastrous budget.

Having copped a political pasting that nearly saw Prime Minister Tony Abbott toppled by his own colleagues, the Treasurer has delivered a far more palatable budget for middle Australia.

Families, small business, tradies, pensioners and the unemployed are all given a hand up in a budget that offers little in the way of big ticket reform.

• Winners and losers of Budget 2015

• Paul Bongiorno: a budget to save Joe’s bacon

• Go moderate, go late, go small business!

• The strangest measures in Budget 2015

• Welfare cut from anti-vaxers

• Tourists slugged for budget repair

It’s a case of once bitten, twice shy with the Treasurer abandoning earlier fiscal heroics in favour of a more circumspect road to surplus.

But according to the budget papers, the outlook for the economy remains quite positive. Economic growth is forecast to climb to 3.25 per cent while household consumption will also rise to 3.25 per cent, from 2.75 per cent at present. Happy days!

Joe Hockey’s second budget harks back to John Howard’s voter-friendly approach. Photo: Getty

Budget purists won’t find much to cheer about but this year’s economic blueprint, with its ‘have a go’ mantra, is focused on wooing Coalition voters turned off by last year’s hard-hearted approach.

Indeed the Prime Minister appears to be mimicking the election-winning, voter-friendly budgets handed down by his mentor, former Liberal PM John Howard.

Take the $5.5 billion package of sweeteners for small business. The budget includes a well-flagged tax cut of 1.5 per cent for enterprises with turnover of less than $2 million a year. In what will be an oft-heard line, the Treasurer hailed this new 28.5 per cent tax rate as ‘the lowest small business company tax rate in almost 50 years’.

But just as important – and in a move that squarely targets the so-called Howard Battlers – the budget also offers small enterprises an immediate tax deduction for every item they purchase up to $20,000.

According to the government, this move alone will help more than two million enterprises, many of them suburban tradies and sole traders who are often forgotten when the budget goodies are handed out.

‘Good news budget for small business at last’, was how one industry group greeted last night’s fiscal statement. In fact the overall response to the budget was pretty positive, a far cry from the wall of criticism that greeted Hockey’s first attempt at balancing the books.

Having realised that it overreached in policy and political terms 12 months ago, the government has abandoned the rhetoric of a debt-and-deficit disaster while neatly sidestepping predictions of when the budget might return to surplus. Hockey’s bold prediction – that it will return to surplus “as soon as possible” – is about as equivocal as one can be.

Small businesses were among the winners. Photo: AAP

This is a small target approach with a fair helping of sugar from a government that has returned to its conservative base and spurned ideological pressure for sweeping changes. Some of the most punitive measures from the first budget – such as forcing people under 30 to wait six months for the dole – have been sensibly dumped.

Likewise the government has watered down or abandoned some of the more radical changes to the pension and GP co-payments.

Stung by sustained attacks on the perceived unfairness of its approach, the government is taking a gentler approach while acknowledging the hard work that is needed to ensure Australia’s unbroken 25 years of economic growth – the second-longest continuous period of growth in the developed world – continues apace.

This budget mimics the Howard budgets of yesteryear, shrewdly targeting key constituencies with careful spending that will make it hard to oppose when measures come before the Senate.

Two areas that have been cut – foreign aid and public service outlays – are unlikely to cause a major backlash, although the government will be accused of being mean-spirited.

Yes, there is a fair amount of spin and smoke-and-mirrors treatment in key portfolios. A number of industry groups will be upset by cutbacks to spending.

But overall this is a far more compassionate budget that sets the government on the road towards a possible early election. And that would have been considered highly unlikely just a few months ago.

Steve Lewis has been reporting politics in Canberra since 1992 and is the co-author of the best-selling Marmalade Files and its sequel, the Mandarin Code. He is a senior adviser to Newgate Communications.