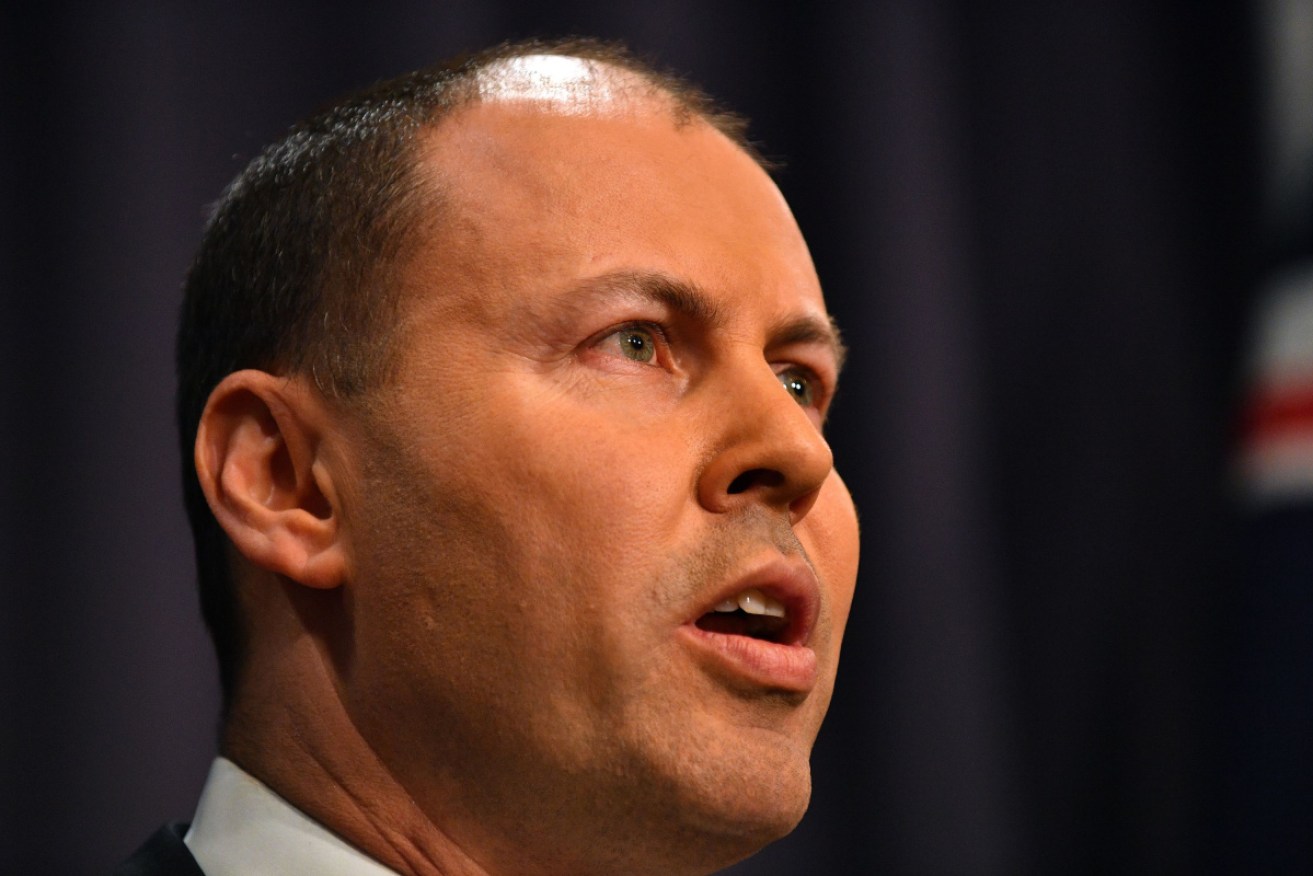

Treasurer Josh Frydenberg could rescue consumer confidence

Treasurer Josh Frydenberg admits loans became harder to get as a result of the scandals brought to light. Photo: Getty

What a fickle bunch we are. The largest annual rise in wages growth in three years wasn’t enough to lift the mood of the nation, with consumer confidence falling in the past week.

But retailers shouldn’t get too disheartened just yet heading into the crucial Christmas shopping period.

There is a chance federal Treasurer Josh Frydenberg could prove a knight in shining armour for shopkeepers and their customers when he hands down his first mid-year budget review next month.

The Mid-Year Economic and Fiscal Outlook (MYEFO), to give it its official title, is expected to show a further improvement in the budget bottom line with higher-than-expected iron ore and coal prices boosting tax receipts.

The most recent government figures show after just three months of this financial year, the budget bottom line was $9 billion better off than expected in May.

It suggests Mr Frydenberg has scope to announce further personal tax cuts, or at least bring forward the timing of those already legislated. Opinion polls suggest the coalition government is in dire need of a boost heading into next year’s federal election.

Malcolm Turnbull, before being ousted as prime mister, had promised to bring forward legislated personal income tax cuts pencilled in for 2022 and 2024 if the budget improved.

It’s worth remembering consumer confidence – a pointer to future consumer spending – grew for six consecutive weeks around the time of the May budget in anticipation of the personal tax cuts that were subsequently delivered.

Australian Bureau of Statistics figures released earlier this month showed retail spending grew by a solid 1 per cent in the June quarter and around the time of this surge in confidence. In contrast, spending grew by a limp 0.2 per cent in the subsequent three months.

Mr Frydenberg is unsurprisingly keeping his cards close to chest, although he does point out the government has recently brought forward the timing of tax cuts for small and medium-sized businesses.

“(But) I’m not going to get into the pre-MYEFO speculation,” the Treasurer said, when asked on Sky News about a further cut in personal taxes.

Of course, he could have just said no. What we do know, however, is the weekly ANZ-Roy Morgan consumer confidence index dropped 1.7 per cent, ending three weeks of consecutive gains.

It was a disappointing result given official figures last week showed annual wages grew 2.3 per cent, comfortably above the rate of inflation for the first time in a couple of years.

The unemployment rate also stayed at a six-year low of 5 per cent after another sharp rise in full-time workers.

Additionally, the cost of petrol, which was gobbling up a growing proportion of the household budget only a few weeks ago, has eased again.

Still, ANZ head of Australian economics David Plank isn’t too panicked by the latest result, believing the decline in confidence is no more than the consolidation of gains seen in the previous three weeks.

Releasing the confidence survey on Tuesday, Mr Plank said confidence is still well above its long-run average and a little above its level of a year ago.

“This is despite the fact house prices have been falling for more than a year on average for the country as a whole, albeit with considerable regional variation,” he said.

Confidence has also held up in the face of a barrage of negative predictions surrounding house prices in recent weeks, including the dreaded ‘recession’ word now being bandied around.

Colin Brinsden is a former Australian Associated Press economics correspondent based in the Canberra Press Gallery.