Hey PM, you’re either lying or ignorant about the RBA’s forecasts

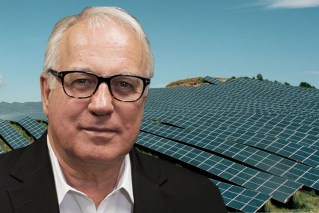

"The forecast the RBA has outlined is now consistent with the forecast we had in the budget." Really? Photo: AAP

Prime Minister Scott Morrison is either desperately lying or ignorant about the Reserve Bank seriously downgrading Australia’s economic outlook – a downgrade that could easily wipe out the government’s “back in black” surplus claim.

“The forecast the RBA has outlined is now consistent with the forecast we had in the budget,” Mr Morrison told reporters on Saturday.

No. That is blatantly untrue.

In the crucial areas of GDP growth and consumption, the RBA on Friday downgraded expectations below the Treasury figures the government is relying on to promise a surplus in the new financial year.

The budget and Treasury’s Pre-election Economic and Fiscal Outlook (PEFO) forecast year-average, real GDP growth of 2.75 per cent in 2019-20. The RBA now says it will be 2.5 per cent.

A quarter percentage point might not look like much, but it’s enough to threaten the claimed $7 billion surplus.

That’s particularly the case when you consider where the RBA highlights further weakness.

The RBA has cut its forecast of consumption growth from 2.5 per cent to 2. The Coalition’s budget forecast growth of 2.75 per cent. Ouch.

It’s not just the government’s economic credibility at stake here.

If the RBA is right, the states are facing further trouble with their GST collections. With that 2.75 per cent consumption growth forecast, Treasury warned the states that GST receipts were expected to grow by only 2.4 per cent in the new financial year, down from 4 per cent this year. Ouch again.

Perhaps one should give the PM the benefit of the doubt about knowing the central bank had just fired a torpedo at his economic credentials – much of the media seemed to miss it on Saturday morning, too.

A quick flick through the papers in the coffee shop showed the importance of the story was either missed or somewhat hidden.

The Australian played the downgrades small, in both space and positioning.

The Australian Financial Review gave it plenty of column space, but back on page four when it was the major economic and political story of the day.

And Sunday’s Insiders program on the ABC failed to mention it at all, despite devoting considerable discussion to whether Labor would be able to achieve its surplus forecasts. It was curious.

It’s also worth underlining how curious it was that the RBA didn’t trim interest rates last week in light of the downgrades. I can’t remember any similar lack of action when faced with such revisions.

For the Prime Minister, it looks more like a deliberate attempt to mislead the public.

The RBA, for all its forecasting mistakes, continues to have more economic credibility than our politicians of either party.