Retail shakeup: Why that big David Jones or Myer near you might be on its way out

Myer and David Jones could be casualties of a retail revolution.

The revolutionary move in retail to online that was heightened by lockdowns last year, when shoppers were housebound, is leaving department stores high and dry.

Myer’s half-yearly results released this week showed this, with the giant’s sales dropping 13.1 per cent and its underlying profit being held in the black only by Jobkeeper.

So financially, like David Jones, it is looking like a dinosaur – and the one in your suburb might be earmarked for closure in coming years.

Myer sales totaled $1.398 billion while its underlying net profit was $42.9 million. That was held up by the taxpayer with $50.7 million in Jobkeeper subsidies.

David Jones has not reported yet but for the June year it lost $33 million, with the second half unlikely to be even that bright.

A look at some of Myer’s competitors tells you where the action is in retail. Harvey Norman saw its sales rocket 27 per cent, to $3.74 billion ($2.4 billion in Australia), and its net profit jump 116.3 per cent, to $462.03 million.

A look at some of Myer’s competitors tells you where the action is in retail. Harvey Norman saw its sales rocket 27 per cent, to $3.74 billion ($2.4 billion in Australia), and its net profit jump 116.3 per cent, to $462.03 million.

While boss Gerry Harvey copped flack for refusing to pay back $13 million in Jobkeeper, you could hardly say it held the fort as it did at Myer. Meanwhile, online high flyer Kogan saw sales up a massive 97 per cent, to $638.2 million, and its net profit soared 250 per cent, to $36.5 million.

That all means that Myer is in a big-money bind.

“Its stores are pretty outdated and it is capital hungry [meaning its owners have to invest a lot to keep it going] so it’s in a vicious cycle,” said Brian Walker, principal of advisory group the Retail Doctor.

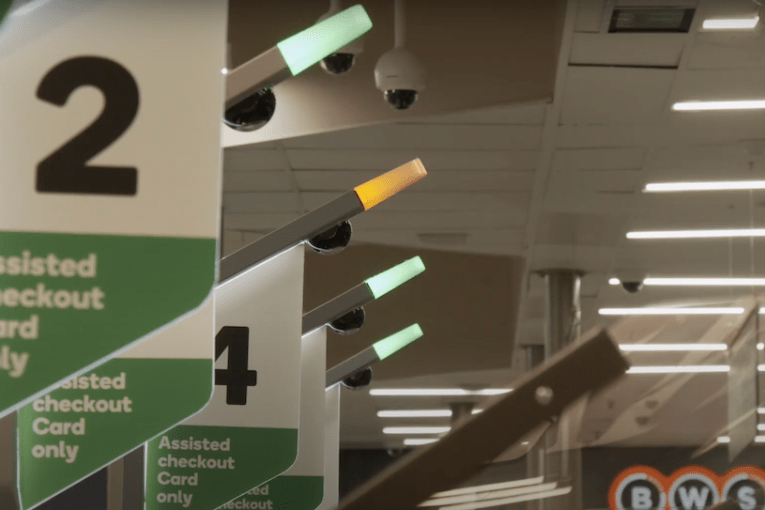

Online and in store shopping balanced each other out during the pandemic

The difficulty for Myer and David Jones, which is yet to report for the half, is not just the internet. Myer’s online sales jumped 71.0 per cent, to $287.6 million, which is a respectable 20.5 per cent of total sales.

“What was interesting to me about Myer’s results was that strong online performance,” Mr Walker said. “Online alone would probably have a market capitalisation of around $2 billion which would put it at a similar level to Kogan.”

But getting people to buy online is not the be-all of modern retailing. “Look at JB Hi-Fi – even though shops were closed at some points they have relied on physical retail, with 72 per cent of its business being physical in-store,” Mr Walker said.

To survive in modern retail it is all about having the right offer for the customer everywhere. “It’s about omni channels – having an attractive offer online and in-store,” Mr Walker said.

Kogan founder and CEO Ruslan Kogan turned in a strong performance during lockdown. Photo: TND

Harvey Norman has become a master in that space. “It has a really strong offering in furniture, furnishings, brown goods [electronics] and white goods,” said Steve Kulmar, principal of RetailOasis.

While Myer has those things to some degree “they don’t have the range of Harvey Norman”.

“Myer is still playing round in the traditional fashion apparel sector. That is competitive [with lots of specialty operators] and people weren’t getting dressed up and going out last year,” Mr Kulmar said.

Harvey Norman has a franchise model which means that each section in a store is run by an owner who can focus on a particular market and customer service.

“It means you can find someone on the floor to help you, which is very hard in department stores,” Mr Kulmar said.

Myer and DJs are, as their finances show, massive ocean liners that will be expensive, and perhaps impossible, to turn round. Kogan made $36.5 million on sales of $638 million and Harvey Norman made $462 million on sales of $3.74 billion.

Myer made nothing on $1.39 billion in sales and DJs lost $33 million on $2.06 billion in sales. That effectively means, like ocean liners, there’s a lot of stuff under the water that you can’t see. The engines have to push it all, but its not making the cash to pay for the fuel.

Myer needs lots of investment to make it modern. Photo: AAP

“Department stores do have a future but they can’t see what it is yet,” Mr Kulmar said.

“They have an extraordinarily strong brand, but they have to invest in online.

“That means investing in IT systems, in distribution, and in warehousing because they have to reinvent their businesses.”

“That means a whole lot of capital investment. They know they have to change but they don’t want to commit to the speed of change because of the cost and its difficult,” Mr Kulmar said.

“Myer has 60 stores and David Jones 47. They need a good CBD presence and higher value stores in some areas but they don’t need all those,” Mr Walker said.