Alan Kohler: How Richard Nixon planted the seeds for cryptocurrency 50 years ago

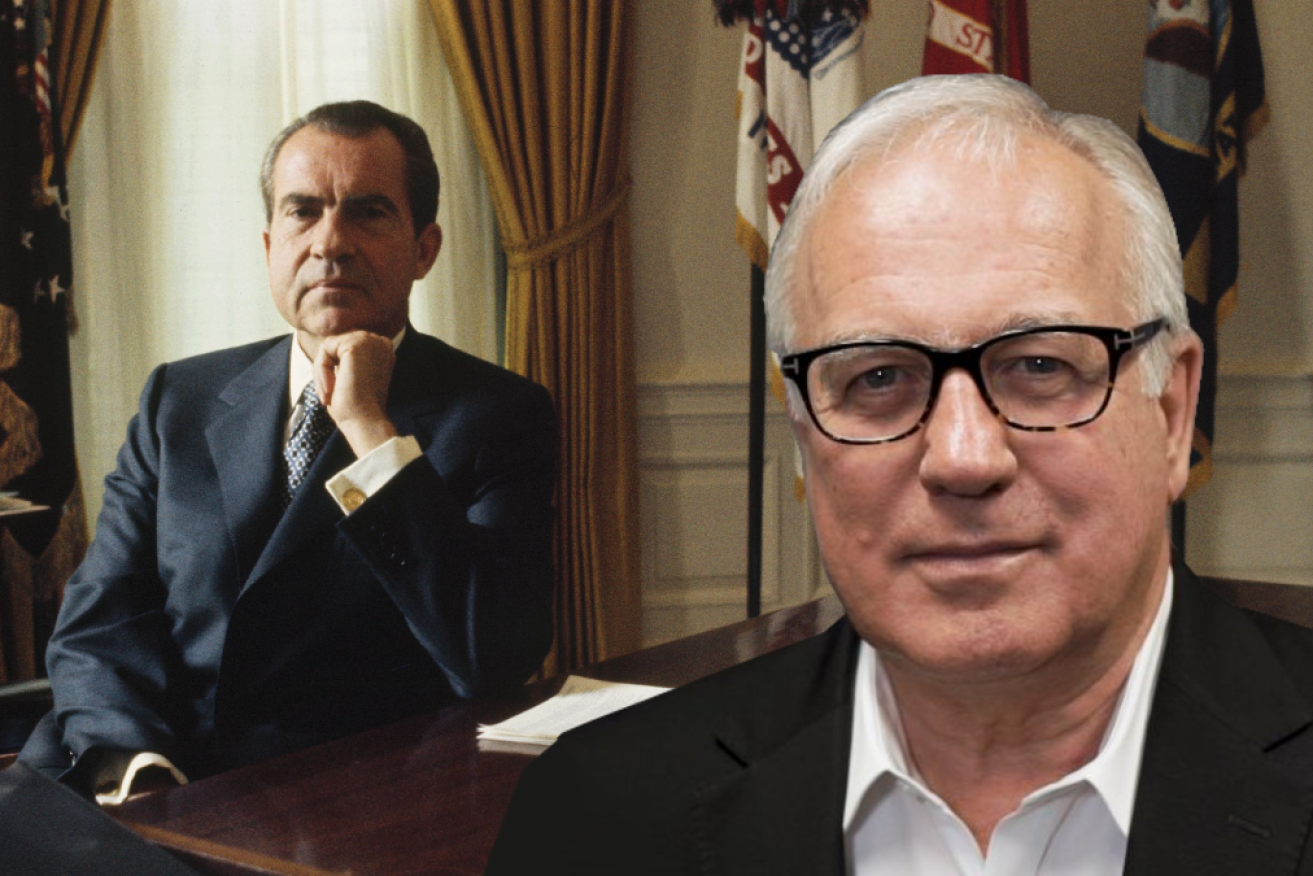

Nixon's scrapping of the Gold Standard planted the seed for cryptocurrencies decades later, writes Alan Kohler. Photo: TND/Getty

On the helicopter headed for a top secret three-day conference at Camp David 50 years ago last Friday, Richard Nixon’s speechwriter, William Safire, was sitting next to a Treasury official.

“What’s going on?” the Treasury guy asked Safire.

“It’s no big deal,” Safire replied. “We’re probably just going to close the gold window”.

Safire recalls that the Treasury official put his head in his hands and whispered: “My God”. Hmm, thought Safire, this could be a big deal after all.

It was a very big deal.

Nixon’s televised address to the nation on August 15, 1971, which resulted from that meeting, became known as the Nixon Shock and involved three announcements:

- A 90-day freeze on wages and prices to counter inflation

- An import surcharge of 10 per cent to protect American industries

- The “temporary” suspension of the US dollar’s convertibility into gold.

The third of those was a genie that couldn’t be put back in the lamp, and so it became permanent.

It meant that after 1971, the world’s reserve currency rested on the credibility of the Federal Reserve, which had been independent from US Treasury since 1951 (the Reserve Bank of Australia didn’t become fully independent until 1996).

But now the world is changing again, as a direct result of what happened then.

Money is going digital.

Instead of gold and the Fed, money is moving back to being based on trust – that is, on agreed information, not on a yellow metal dug up from holes in the ground or on the economic druids in central banks whose main job now is to print more money and create an oversupply of it.

But first, an excursion back into history.

A new world order

After a meeting in July 1944 of all 44 allied nations’ finance ministers at Bretton Woods, New Hampshire, the US dollar could be converted into gold at a rate of $US35 ($47) an ounce, and the other major currencies of the world were pegged to the US dollar.

With the chaos of WW2 coming to an end, there was basically no functioning world economy – no working system of trade and no monetary structure – so a new one had to be built from the ground up.

The Bretton Woods System, as it became known, placed the US dollar at the centre of the global monetary system and anchored the system to gold, removing the prospect of competitive devaluations and providing stability for post-war trade and finance.

It was a massive success. The US dollar became the first truly global currency and everyone was happy to hold it because they could convert it into gold whenever they wanted – it was genuinely as good as gold.

The International Monetary Fund was set up at Bretton Woods as the global money police, making sure everyone kept within their lanes.

But in the early 1970s the system was coming apart at the seams: The US dollar exchange rate hadn’t changed in 27 years and inflation caused by the Vietnam War meant it had become massively overvalued. The pressure for a devaluation was irresistible.

So Nixon effectively created a system of “fiat” money, in which a currency has no intrinsic value supported by a commodity (gold or silver), and is based either on the credibility of the government that issues it, or what the people trading it think it’s worth, or both.

And sure enough, since 1971 the US dollar has devalued by 80 per cent and the US consumer price index has increased eight-fold after a century of stability.

The inflationary era ushered in by the Nixon Shock lasted 37 years and one month, until the global financial crisis brought the capitalist system to its knees on September 15, 2008.

Satoshi Nakamoto’s Bitcoin white paper was published six weeks later.

QE and the birth of Bitcoin

A new era of quantitative easing began in November 2008, when the Fed started creating money to buy assets (first mortgage securities, later government bonds) because it couldn’t cut interest rates below zero, and later because governments needed to raise so much debt for fiscal stimulus.

Separately, Nakamoto’s white paper quietly started the era of blockchain and digital currencies.

It took almost a decade for crypto to catch on, but as the Fed printed more and more money, more and more people got interested in the alternative.

It’s hard to decide which of those events in 2008 – the GFC or the birth of Bitcoin – was the most significant. But in the 13 years since they have merged anyway: The fact that the US Federal Reserve has brought $US8 trillion ($10.9 trillion) cash into existence since 2008 is largely responsible for Bitcoins now changing hands for $US47,550 ($64,520) each.

As discussed here last week, the pandemic, and now climate change, means that the emergency debasement of the fiat money system to preserve employment and bankroll government spending will be as permanent as the closure of the gold window was in 1971.

And after a 37-year interval of inflationary, government-controlled fiat money from August 15, 1971, we are now moving from the earlier system of commodity-based money to one that’s based on data.

Which makes sense: Digital bits and bytes and instant data transport rule our lives, so why wouldn’t they rule money as well?

Ben Bernanke (R) was the chairman of the US Federal Reserve during the GFC. Photo: Getty

After thousands of years in which gold and silver were the means of exchange and value storage, and then 50 years of benign inflationary chaos after Richard Nixon cut money loose from gold, digitisation is now taking over everything.

Whether it will be the anchorless rebellion of cryptocurrencies, or central bank digital currencies still controlled by the new gods of finance (independent central bankers), the world is moving to money based on shared information rather than gold or the credibility of governments.

That credibility has been well and truly destroyed by a succession of expensive, pointless wars and fiscal populism, and central banks are trying hard to lose their credibility as well by treating money as a magic pudding.

Whether Bitcoin and the other cryptocurrencies will ever have enough credibility to replace gold and government fiat is another matter entirely, but perhaps that’s the wrong way to look at it.

Maybe what replaces it is a system of truth, not credibility.

Rather than relying on belief in a shiny metal, or belief in populist politicians and secretive central bankers, maybe the new system can be based on shared knowledge that is stored on transparent, unchangeable blockchains.

If you know, you don’t have to believe.

Alan Kohler writes twice a week for The New Daily. He is also editor in chief of Eureka Report and finance presenter on ABC news