As federal law reform drags on, Geelong pensioner the human face of irresponsible lending

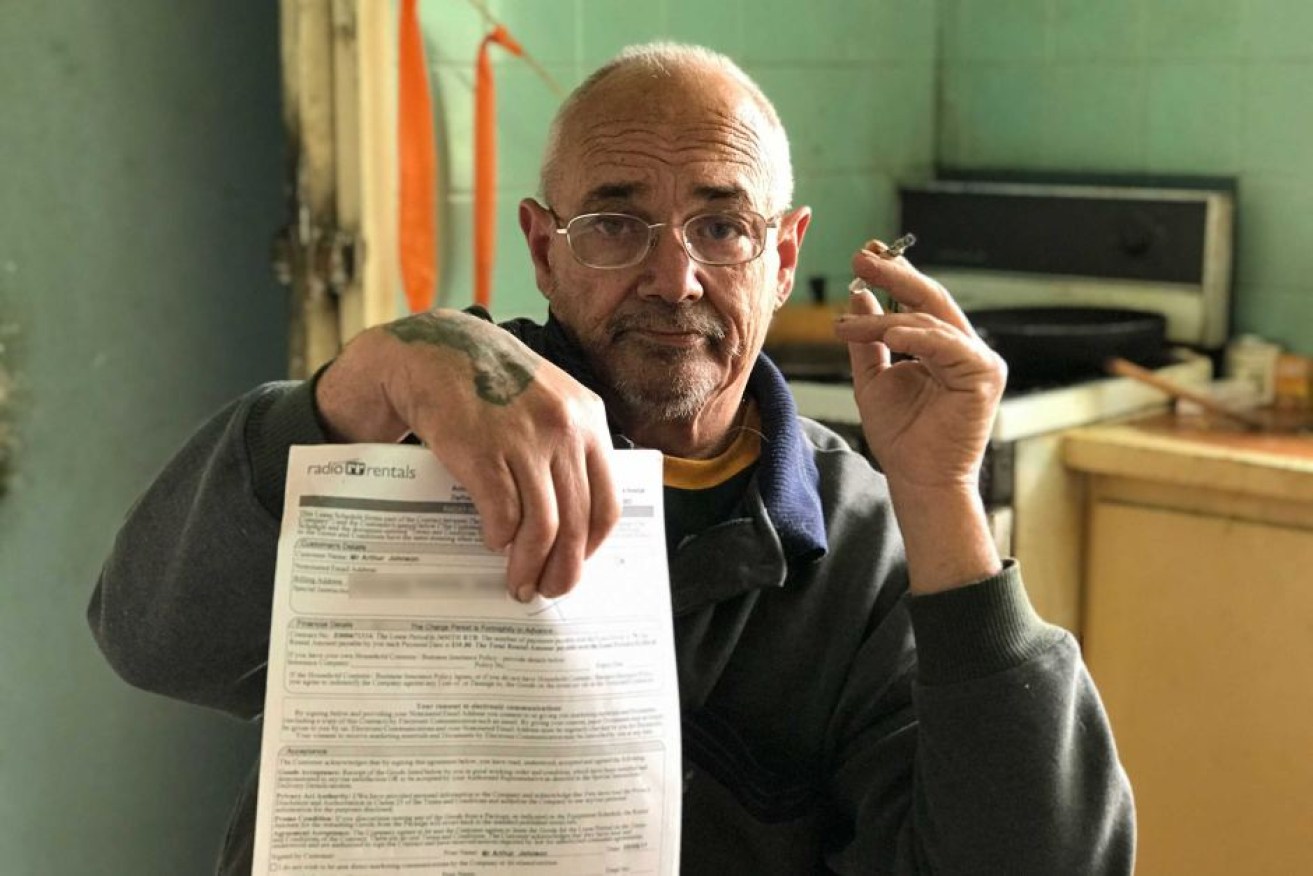

Arthur Johnson's lawyers believe he may have been subjected to irresponsible lending practices. Photo: ABC

Signing leases with Radio Rentals for a Blu-ray player and a stereo system has left Melbourne pensioner Arthur Johnson struggling to pay for the bare essentials.

“I’m finding it hard to put food on the table,” he said. “It’s getting me depressed. I have bills hanging over my head and I’m in a rut.”

The 66-year-old lives alone near Geelong with his dog Harry, and will end up paying nearly $4000 for the products, despite the stereo only being worth $1799.

He is currently paying for the products through Centrepay, so the repayments are coming straight out of his pension.

His lawyers are worried he has been subjected to irresponsible lending practices and are trying to help him get out of the contracts.

Mr Johnson says he will go without food before his dog does, and that is becoming more and more likely.

Industry is being given too long to introduce change

It is to stop situations like that faced by Mr Johnson that the Federal Government has proposed reforms to consumer lending and pay day loans.

Consumer and financial groups have been pushing for the changes, but are worried the industry is being given too long to change their behaviour.

Their concerns were raised in a joint submission to the Government from across the country, signed by Consumer Action Law Centre, Financial Rights groups, United Church, Choice, Indigenous Consumer Assistance Network and the Consumer Credit Legal Service WA.

The groups are calling for the Government to bring in reforms within six months of laws being passed, saying the proposed 12 months is “overly generous”.

“These products are incredibly harmful and the industry is already on notice,” Katherine Temple from Consumer Action Law Centre said.

Arthur Johnson with the products that have cost him dearly.

A review panel made recommendations for reform in November 2016 and the Government plans to introduce amended laws to Parliament by the end of the year. Any debate could have to wait until next year.

The group submission is calling on the Government to ensure the 10 per cent income cap on contract repayments takes effect as soon as the laws are changed, as well as ensuring the total payable amount is not hidden in the fine print.

Door to door loophole

Jon O’Mally from the Indigenous Consumer Assistance Network (ICAN) says there has been heavy lobbying from within the industry to try and stop the reforms.

ICAN has long held concerns about remote communities exposure to consumer lease traps, particularly door-to-door sales.

Under the proposed changes door-to-door selling of consumer leases will be banned, “except by prior arrangement”, which consumer groups says is a significant loophole.

“We are talking about our clients who are going without food and are at risk of homelessness because of the pressure of payday lenders and consumer lease companies,” Mr O’Mally said.

“Door-to-door selling is very evident on vulnerable communities particular with consumer lease companies.

Some companies just walk into the community centre — which is still door-to-door selling.”

The group submission says the loophole in door-to-door sales will allow companies to “circumvent the reforms”.

The Credit and Investment’s Ombudsman’s annual report shows complaints about small and medium amount lenders were second only to complaints about debt collectors.

-ABC