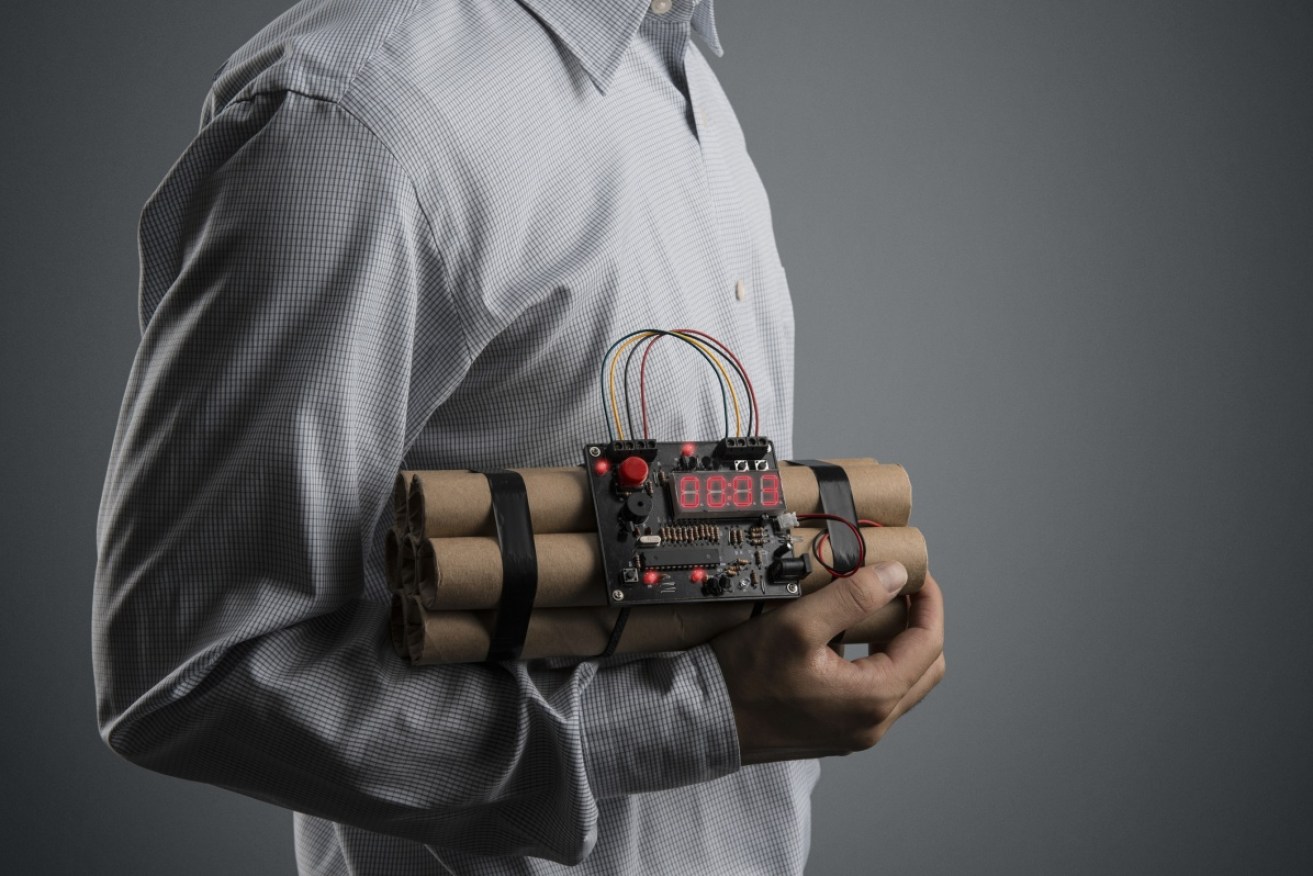

Super-for-housing is a time bomb for the budget

The small fiscal time bomb identified in the 1990s is much bigger today. Photo: Getty

It is almost unbelievable that the Coalition is still fighting internally over whether or not to allow young Australians to use superannuation savings to help fund the purchase of their first home.

In political terms, it is doubly damaging. It highlights not only the weakness of the Turnbull-Morrison leadership – who know it’s a stupid idea – but also the economic illiteracy of the Tony Abbott-led forces who support it.

In economic terms it is negative on every count. It would:

- Help pump house prices and the housing credit bubble even higher;

- Punch a hole in future super-funded retirement incomes;

- Heighten systemic risk within the banking and home mortgage sector;

- Shift locally created capital out of productive investments and into a single, highly risky asset class; and

- Exacerbate inequality by transferring even more wealth from younger home buyers, to older home-sellers.

Those consequences alone would be bad enough. But crucially, the idea would also cause future government pension payments to balloon, and therefore create pressure to raise taxes.

The dent such a scheme would put in the retirement income system would take Australia back decades.

The budget bomb

When the first federal age pensions were paid in 1909, using a direct tax/transfer funding model wasn’t much of a problem. The retirement age was set at 65 for men and 60 for women, but life expectancies at birth were then 56 and 61 respectively.

By 1990, when the Keating government started working on a compulsory super scheme, they could already see a fiscal time bomb set to go off a couple of decades down the track.

Life expectancy at birth was then 75 for males and 81 for females, but Paul Keating himself later admitted he’d failed to see how much that would rise in the decades ahead – the figures are now 80 and 85, and rising.

In 1990, PM Paul Keating failed to fully anticipate the ageing population trend. Photo: Getty

The ageing population just could not be supported with a tax/transfer model. Compulsory super savings would have to be invested instead, and grown over many years to cover Australians’ retirement needs.

What Mr Keating saw as a small time bomb back then has now become a really big one. ABS demographers forecast a quarter of Australians will be aged over 65 by 2041.

Against that backdrop, it is staggering to think Liberal backbenchers are agitating to shift capital from the national super savings pool into the over-valued housing market.

It’s almost a declaration of war on the young – when you’ve all lost a large chunk of your super savings to the coming property price correction, you and your children will have to pay higher taxes to fund pension payments to make up the shortfall.

It’s not the only way to wreck the future for young Australians, but one of the most certain.

That it is even being discussed highlights an alarming dearth of economic sense on the government’s backbench.

The Prime Minister and Treasurer simply must show some spine and prevent those agitators wreaking ideological havoc on the nation.